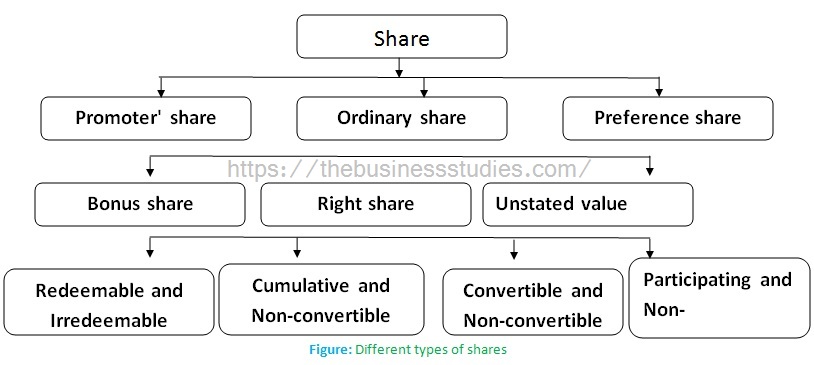

Share of company is a part of the share company. The capital of a company is divided into a number of equal parts. Each part is a share of the share capital. For example, if the authorized capital of the company is the TK. one million and it is divided into 10,000 equal portions, and then the company has 10,000 shares of take, 100 each (face value). Share means share in the share capital of the company’ {2(16), Companies, Act, 1994}. Share is usually of three kinds: 1. ordinary share 2. Preference share 3. Promoters share.

1. Promoters share: These are ordinary or common shares subscribed by the promoters as qualifying shares. The original initiators or promoters in case of public limited company are required to purchase minimum number of shares known as qualifying shares. These are promoters share.

2. Ordinary shares or Common share Equity s hare: Share, which represent the ownership right in a company or corporation, is knows as common stock or equity shares. The owners of these enjoy ownership right voting right, and participation in management right, right to dividend & of residual claim over the assets of a company in case of liquidation.

These shares may be:

- Par value shares with specific face.

- No par value share – share with any specify face value.

- Started value share some common shares have stared value and others without any started value.

- Deferred shares that have a deferred claim after common & preference shares founder’s shares that are distribute among founders or promoters with some restrictive rights.

(a) Bonus share: Share distributed as bonus to shareholder with any payment by capitalization undistributed profits or restrained earning. For different purposes, company keeps reserves and latter on these reserves may be redundant and company may decide to distribute these among the shareholder. Payment of dividend through shares know as stock dividend, is also knows as bonus share.

(b) Right share: Common share distributed among existing shareholders under preemptive right. In a established company, share become very lucrative. To protect the right and control of existing shareholders. Shares (of addition issue) are given to the existing shareholders are a right. The shareholder may exercise the right or sell it. Such issue is known as right issue.

3. Preference Share or preferred Stock: A kind of equity share is known as preference share, which has preferential claim over dividend and assert, but no voting and ownership right.

Usual features associated with preferred stock are: 1. accumulation of dividends 2. Conversion feature 3. Call feature 4. Participation features and 5. Par value. On the basis of different right and terms, preference shares may be of the following categories.

- Redeemable Preference Shares: Preference shares which are redeemed or repaid are Redeemable preference Shares. These are redeemable after the stipulated period. If not redeemable, then Irredeemable Preference Shares which shares are not redeemable within the lifetime of the company. The Life of these shares extends unto the life of the company.

- Participation preference Share: Preference shares which having the right to participate in the residual dividend with the ordinary shares over and above their preferential dividend is knows as participating preference shares. Shares with this right is not participating prefer shares.

- Cumulating preference Shares: Share having to arrear dividend is knows as cumulative preference for share. For previous years in which was not paid accumulation shares on these prefaced shares . Share without this right is a non -cumulated preen the preference share. Preference shares are also called preferred stock.

- Convertible preference Shares: Preference shares which are associated with the right of conversion to common share is known as convertible preference share.Preference share is called a hydroid security and on the basis of right added, it may be of different varieties, such as Redeemable and participating preference Shares. Redeemable and participating and Convertible preference Shares, Redeemable. Convertible, Cumulative and participating preference Share, etc.